Why Yuan Can’t Replace Dollar As The Global Currency

By Kumar David –

There is a school of thought (my sparing partners I call them) which contends that the mighty dollar is on its way out as the global trade and reserve currency. Though the argument is flawed it is not without merit. The IMF estimates that China’s economy grew by about 1.9% in pandemic ravaged year 2020 while it declined by 4.3% in the US in the same year. Forecasters now expect the Chinese economy to expand by a stellar 8% in 2021 and the US at a modest 2%; star gazing beyond 2021 is silly till the shape of the post-corvid universe is clearer. Depending on which ‘erudite’ bunch of dismal scientists you consult the Chinese economy will overtake the American in size somewhere between 2028 and 2032 on a nominal currency basis – it is already bigger on a PPP basis. These numbers are impressive and relevant for a different discussion, viz. choice of a development model (free-market capitalism supported by liberal democracy versus a government-led mixed economy under the guardianship of a strong centralised state) for the developing world if not others as well. But I argue that these striking statistics do not sufficiently support my challengers’ case for the likelihood of the Yuan emerging as an alternative to the dollar as the world’s global currency.

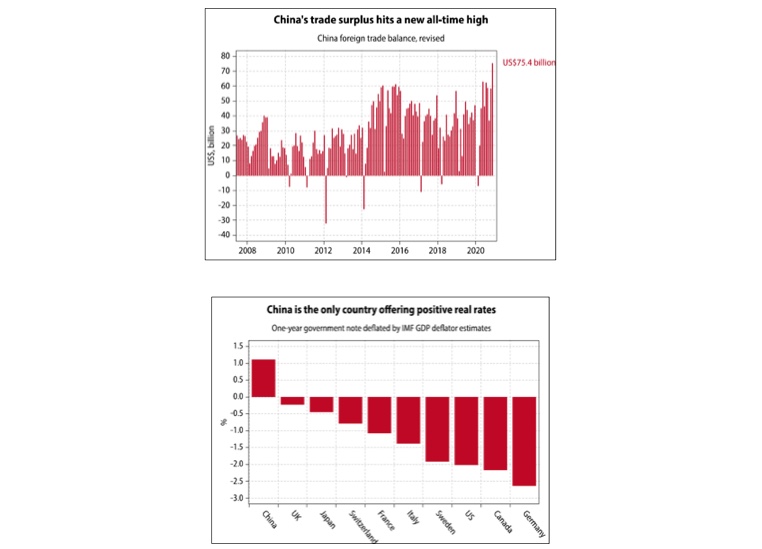

My sparing partners then respond with two other economic trends that are more relevant to the dispute – foreign trade balances and interest rates. China’s trade surplus has averaged about $40 to $50 billion a month since 2015 and in post-covid November 2020 shot up to $75 billion. The high positive trade balance scenario is likely to persist throughout 2021 and 2022 as the rest of the world recovers and imports capital good from China to underpin recovery. Or, other economists argue, it may be a short-lived spike since others will enhance their output and need less from China. (It was Harry Truman who lamented “Oh for a one-handed economist. All my economists say ‘on one hand…’, then ‘but on the other…”). Admittedly the currency of a country with a large trade balance and foreign currency reserves ($1 trillion in China’ case) is a candidate for global status.

The second point that proponents of the Yuan-thesis advance is that China is the only country offering positive interest rates on one-year government bonds after the conventional deflators to deduct the effect of inflation on yields are taken into account. They, my detractors, back it up with remarks like “The whole US$ house of cards will tumble when inflation flares up in the US – already happening but hidden by using bogus inflation measures such as PCE inflation, which measures the inflation experienced by the rich 1%. Before long even PCE inflation will exceed 2%”. (The Personal Consumption Expenditure in gross domestic product consists of expenditure of households on durable and non-durable goods and services). I do not agree that PCE is a bogus inflation deflator, but I do concede that an increase in the US inflation rate above the prevailing 1.2% to 1.5% range is very likely. Advocates of MMT that is Modern Monetary Theory (the debt obsessed guys who want to run the electronic money printing press all day and all night) are deluded that inflation is a bogey of a bygone era. I am not a convert to MMT but let that pass; I have discussed it in previous columns.

There are five fundamental reasons why the Yuan cock won’t fight nor win the battle to become the global payments and reserve currency option in the foreseeable future. They are:-

* There is nowhere near enough Yuan in circulation to lubricate all global investment and trade. Or to put it in other words; Chinese financial pockets are nowhere near deep enough to meet global needs.

* The Yuan is not freely convertible, either due to restrictions or because some jurisdictions are not in a position to process Yun transactions with adequate flexibility.

* Chinese financial markets and banks still constitute a relatively ‘closed economy’.

* The dollar’s successor will be a bastard mix of the Dollar, Gold, Euro, Yuan and SDRs – (Yen?).

There is about $2 trillion worth of US dollar bills in circulation. It is the most popular currency in use worldwide — central-bank reserves, wealthy people’s cash holdings, and money laundering. Grounded on the historical reach and power of US Imperialism since WW2 and because of America’s political stability (Trump’s attempted coup gave everyone a fright though) it is the most liquid currency as a global store of value and safety net. There is about $5 trillion worth, in all currencies, in circulation throughout the world, most of it domestic except the $, Euro, Pound and Yen. The five trillion is what is called the narrow money supply, which is notes and coins. But using a more inclusive definition of money called broad money the amount is much higher since it adds the money in bank current and savings accounts and money-market accounts. This is all money that can be quickly digitally accessed and used. Estimates of the quantum of global broad money vary; the IMF puts it at $35 trillion and the CIA $80 trillion. Take one more step pertinent to my argument and include global hedge funds and derivatives, investments and market capitalisations, then global financial value is estimated at between $500 trillion and $1000 trillion. I cannot be sure, but say a third or more is capitalised in US$.

The narrow money supply in China is equivalent to $1.2 trillion in US dollar terms and therefore comparable to the US, while broad money supply is estimated as equivalent to $33 trillion, again comparable to US dollar money supplies. But nearly all of China’s money supplies are held within China and Hong Kong. However, it is when it comes to the value of global investments, funds and market capitalisations that a big difference shows up. Ali’s Ant Groups whose recent IPO was thwarted (or deferred) by the authorities is valued at $200 billion, while the market capitalisation of China’s largest banks including Hong Kong’s banks is equivalent to about $2 trillion. It is impossible for me with zero research support to make a proper estimate of the capitalisation of China’s companies and giant corporations (many state owned) and China’s overseas holdings. But I would be amazed if it all tots up to more than $50 trillion, which is only a tenth to twentieth of global financial values. This is what makes the Chinese Yuan far from ready to sally forth as an alternative global currency.

China has a few useful cards up its sleeve that could tilt the balance to a degree if it decided to play hardball. A shift from the $ to Yuan could happen in the oil market if China, as the world’s largest importer, attempted to create a Yuan-denominated crude-oil market. Or if it demand payment in Yuan for its exports, which will handicap the US which doesn’t earn sufficient Yuan through exports to China to pay for imports from China. At this stage in the discussion I think it necessary to interject that China does not want to launch the Yuan as a global currency and as major alternative reserve and payments mechanism. Anyone who is witness to the currency chaos that the US may soon run into would be wary. The reserve currency status of the $ has let America pay for everything by merely printing money. This can go on for only so long as people are willing to accept it for purchases or to hold it as a reserve. Has China been playing a long game to dethrone the $, as one of my discussants suggests? I am not sure, but for sure US sanctions on Chinese and Hong Kong leaders and attempts to undermine Chinese technology companies (Huawei most clearly) must be pushing Beijing nearer the edge. There is evidence that China has been accumulating gold and furthermore the Chinese 10-year bond yield now is relatively high at 3% – meaning the Yuan is payments-secure.

A reserve currency should be a medium of exchange, a unit of account and also a store of value. The $ passes with flying colours on the first two counts but with a real interest rate of -2% it is failing as a store of value compared to the Yuan which offers investors a real interest rate of +1%. But the depreciation of the dollar against major currencies is a slow and uneven process. On balance and taking into account the arguments I have advanced in this column, clearly the Yuan’s day has still not dawned. And there is a sting in the tail for Sri Lanka; the gods atop mount Yuan are not in a place from which to vaporise our foreign debt chaos by magic.

The post Why Yuan Can’t Replace Dollar As The Global Currency appeared first on Colombo Telegraph.