SHOULD WE BE INFORMANTS TO BOOST TAX REVENUE?

By Sanjeewa Jayaweera

The headline on page one of the Sunday Island of 07 January 2024 read, “CBSL Governor urges public to become informants to boost tax revenue.” The article was based on an interview with Governor Nandala Weerasinghe (NW) hosted by the President’s Media Centre. NW is quoted to have said, “If the public wants to reduce taxes, in the future, what I see is, while they pay their taxes, they should encourage others to pay taxes or inform the authorities on those who are not paying taxes.” He urges the public to become informants to broaden the tax net, which should reduce direct and indirect taxes. His is a clarion call for the citizens of Sri Lanka to discharge their civic responsibility, which is to pay their taxes and help the authorities to catch those who don’t. His logic can not be faulted, as tax evasion and avoidance is rampant in our country.

Despite a significant degree of displeasure with the government over tax hikes that have resulted in a great deal of hardship for most, there remains a question, at least in my mind, as to how many of the citizens will heed the Governor’s advice.

The question is, what would motivate a person to be an “informant.” While there are numerous reasons for a person to be an informant, in the case of reporting those evading paying taxes, the motive can only be good conscience due to civic duty and the belief that widening the tax net would, as NW states, hopefully, reduce the burden on those who pay their taxes. As far as I am aware, the Inland Revenue Department (IRD) does not offer a financial reward to an informant, although IRD officers receive financial rewards for such collections. Maybe the government should announce a reward scheme for informants.

The two main barriers that, in all probability, will not see too many of us becoming informants would be the significant erosion of civic responsibility among most of our citizens. The concept of doing the right thing by the country is missing in our DNA. Over several decades, our politicians have gotten us used to a regime of low taxes, subsidies, free education and health. There is a general belief that the state must be a provider without much thought regarding how the state can generate the needed funds.

Secondly, many do not see the need to pay taxes because they believe those who govern the country are corrupt. The fact that those responsible for corruption are not investigated and prosecuted for their ill-gotten gains further justifies the decision not to pay taxes. I think this segment of people is not opposed to the concept of paying taxes but refrains from doing so because they do not want to contribute to the fattening of the pockets of politicians.

The Significant Impact of Gotabaya Rajapaksas (GR) Tax Policy

Whilst there is a general belief and acceptance that the hare-brained tax policies of the government of GR contributed significantly to the country’s economic downfall, there is still not much appreciation or understanding of the devastating impact it has had on tax compliance by individuals and businesses.

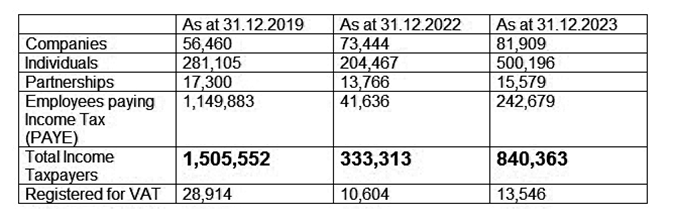

I have reproduced below the statistics pertaining to the number of taxpayers registered with the IRD from the IRD Performance Reports of 2019 and 2022. The figures as of 31.12.2023 are based on a press conference of the Commissioner of IRD from the Presidential Media Centre as reported in the Sunday Island on 31 December 2023.

As can be seen, a significant number of registered taxpayers left the tax net after 31 December 2019. In my view, even the number of registered taxpayers as of 31 December 2019 was significantly less than it should be, with many not paying their taxes. To have legislation enabling most to leave the tax net is astonishingly negligent and foolish. Trying to re-induct those who exited from the tax net will take a lot of effort.

Value Added Tax (VAT)

The Increase in VAT to 18% from 15% and the imposition of VAT on several items previously exempted from VAT, like fuel, gas, and books, has caused a justifiable degree of anger among the public. In all probability, in terms of President Ranil Wickremesinghes’ chances of getting reelected, it might be the straw that broke the camel’s back.

In 2002, when VAT was first enacted, there were two VAT rates, with certain products and services at 10% and some at 20%. Over the years, the rates increased and decreased, but until the recent change, several essentials were exempt from VAT. The extent of exemptions was such that when I retired from employment about six years ago, nearly 40% of the turnover of supermarkets was from the sale of VAT-exempt items. It is a reflection of the array of products that were purchased by the customers deemed to be essentials that were in the exempt category.

In his interview, the Goveror also warned that some businesses may be engaging in VAT fraud. In countries where VAT works well, all businesses have to issue a VAT Invoice to customers, whether they are tax-paying businesses or members of the public. He stated, “In some places when you buy goods, they ask if you want the invoice without the VAT. If I agree to pay less (for the invoice without taxes), my tax burden will never ease.”

Unfortunately, in our country, the IRD regulates that VAT is not reflected in an invoice issued to members of the public. Most consumers do not even know how much VAT they pay when purchasing an item or service. The supermarket bill or the hospital bill does not show the amount of VAT that was paid.

In 2002, the IRD sent a circular to all companies instructing that VAT charges should not be shown in an invoice/bill issued to a member of the public. When I enquired about the logic of this from the IRD, they replied, “We do not want the consumers to see the amount of VAT they pay as this will make them angry!” This lack of transparency is undoubtedly unfair to the public who are bearing the tax and also contributes to fraud by unscrupulous businesses.

How Many of Us Will Be Informants?

Nandalal Weerasinghe is a public servant whom I admire. He has undoubtedly played a significant role in bringing professionalism to the CBSL Governor’s post and has contributed to somewhat stabilizing the economy. However, I believe his call for taxpayers to be informants will not be heeded, and I believe the government has many other tools to improve tax compliance and increase the collection of tax revenues without having to depend on informants.

The revenue collecting agencies like Customs, Excise, and the IRD are considered to be inefficient and corrupt. The public needs to be told what action is being taken to rectify and eliminate these. As I understand, only when a new bank account is opened will a Tax Identification Number (TIN) be requested. Why can’t the government regulate that all existing bank account holders must submit a TIN certificate to the Bank?

I have read a proposal by Verite Research recommending that the withholding tax (WHT) be increased to 10% from the current 5% on bank interest and that such a measure would boost tax revenue by Rs. 100 billion. It makes perfect sense as WHT is not an additional tax but a mechanism for collecting it in advance. The logic in the proposal is that many who receive bank interest are out of of the tax net.

A few eminently sensible proposals that I came across recently that could assist the tax authorities in monitoring tax compliance and arriving at an estimate of an individual’s income are to reintroduce the QR code system to purchase fuel so that the monthly spend can be monitored and also obtain from Uber and PickMe a list of top customers by spend. Similarly, airport departure cards submitted by Sri Lankans, along with their TIN number (disclosure of which should now be made mandatory), would also be a valuable source of information for tax authorities.

Whilst all these may sound like an invasion of individual freedom, they are all tools that the authorities can use to ensure greater tax compliance by individuals as opposed to depending on informants. The question is whether the government is serious about widening the tax net or is content with seeking more and more taxes from the same group of people who pay their taxes diligently and in full and increasing the contribution from indirect tax.

There needs to be greater debate and criticism on reducing unnecessary state expenditures and how taxpayer money should be spent. The expenditure incurred to maintain over 60 overseas missions, which, incidentally is double what Singapore maintains, is a case in point. Astonishingly, the government is considering incurring Rs 250 million to send a naval ship to the Red Sea to combat the threat to merchant vessel lines by Houthi rebels, joining the big boys to protect the key waterway for global trade.

This task is best left to countries that can afford such expenditure and not to a bankrupt nation like ours where critical life-saving drugs are not available at state hospitals. The logic justifying the expenditure will be as flawed as that given for spending Rs 200 million to celebrate Independence Day.

(The views expressed in the article are solely those of the author and do not necessarily reflect the opinions and views of any organization he may be associated with.)