Nexus between money, exchange rate, money printing and inflation

Money, exchange rates, and money printing are crucial components of a nation’s monetary policy framework, wielding significant influence over economic and financial stability. This intricate relationship between these fundamental factors directly affects financial and economic dynamics. I am going to examine the nexus between these factors, clarifying their roles in the financial system and the implications of their interactions. The relationship between money supply and money printing is symbiotic, with the latter directly influencing the former.

Money, exchange rates, and money printing are crucial components of a nation’s monetary policy framework, wielding significant influence over economic and financial stability. This intricate relationship between these fundamental factors directly affects financial and economic dynamics. I am going to examine the nexus between these factors, clarifying their roles in the financial system and the implications of their interactions. The relationship between money supply and money printing is symbiotic, with the latter directly influencing the former.

Money

Recently, Emeritus Professor of Economics, Sirimal Abeyratne, explained the meanings of some economic concepts about money and inflation. He emphasised that in economics, money transcends mere physical notes and coins circulating in the system. Similarly, he clarified that money printing does not entail the simplistic act of “multiplying sacks of coins or bundles of notes”, akin to minting physical currency.

Money supply, often referred to as the money stock, encompasses the total quantity of money circulating within an economy at a given time. It includes various forms of money such as currency, demand deposits, and other liquid instruments. Money supply acts as the lifeblood of economic transactions, facilitating exchange, investment, and consumption activities. Central to the concept of money supply are its determinants, including central bank policies, commercial bank lending practices, and public demand for money. Changes in these determinants can influence the quantity of money in circulation, impacting economic activity and price levels.

Reverse causal relationships

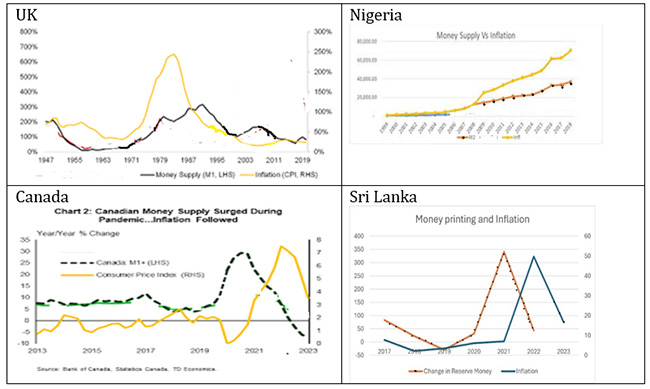

Crucially, Professor Abeyratne highlighted the concept of reverse causation between the stock of money, which is determined (a multiplier) by reserve money, and inflation through the mechanism of increased aggregate demand. It suggests that money supply, can impact aggregate demand, subsequently influencing inflationary pressures within the economy. Therefore by understanding the complexities inherent in concepts like money supply, money printing, and their implications for inflation and aggregate demand, policymakers and economists can formulate more informed and effective monetary policy strategies to foster economic stability and growth.

Money printing

According to Dr. Nandalal Weerasinghe, the Governor of the Central Bank of Sri Lanka (CBSL), money printing can be defined as the change in reserve money, denoted as M0, which represents the injection of fresh money into the economy. Reserves consist of the stock of cash and funds, including statutory reserves, deposited by commercial banks with the CBSL. In 2020 and 2021, the increase in M0 (money printing) was LKR 372 billion, while the money stock (M2 broad) rose by LKR 3,024 billion.

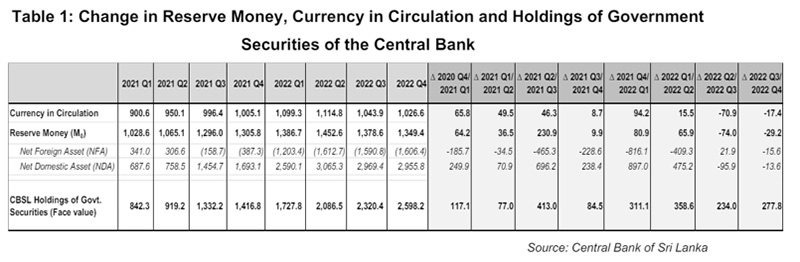

CBSL further explains (Janaka Edirisinghe Deputy Director Economic Research Department) that in economic terms, the Central Bank has two primary methods for issuing new money into the economy. Firstly, when the Central Bank extends credit to licensed commercial banks or the government, it effectively creates new money, termed as the accumulation of domestic assets. Secondly, when the Central Bank acquires foreign exchange from the domestic foreign exchange market or government inflows, it generates new money, known as the accumulation of foreign assets. The combined value of these two assets is referred to as reserve money. Therefore, the main way to measure money printing is by looking at the change in Reserve Money. Table 1 shows this indicator along with other measures used to evaluate money printing. (See Table 01)

Money and Economic Growth

Money printing, also known as quantitative easing (QE) when conducted by central banks, involves the electronic creation of new money to purchase financial assets like government bonds or mortgage-backed securities. Central banks employ money printing as a monetary policy tool to achieve specific objectives such as lowering interest rates, boosting aggregate demand, and achieving target levels of inflation.

When central banks engage in money printing through QE programs, they inject newly created money into the financial system, thereby increasing the overall money supply. This liquidity infusion aims to lower interest rates, stimulate borrowing and spending, and ultimately expand the money supply to support economic activity especially during economic downturns or deflationary periods. However, the effectiveness of money printing in achieving these goals is debated due to potential unintended consequences like asset price inflation and currency depreciation.

Conversely, a contractionary monetary policy, such as reducing the pace of money printing or tightening monetary conditions, can lead to a decrease in the growth rate of the money supply or even a contraction. This reduction in money supply growth can dampen economic activity, increase borrowing costs, and potentially contribute to deflationary pressures.

Nexus of financial factors

From a financial perspective, we may have to go beyond analysing the bi-directional relationship between reserve money and inflation, via mediation of aggregate demand. Deeper study is necessary to explore the multi-directional and mutually co-integrated nature of relationships among the most prominent variables in financial market dynamics. While central banks employ money printing to achieve objectives like lowering interest rates and boosting aggregate demand, its effectiveness and potential drawbacks, such as asset price inflation and currency depreciation, remain subjects of debate.

The nexus between money supply, money printing, aggregate demand, inflation, exchange rate and stock market performance are complex and mutually influential. When central banks engage in money printing, they aim to bolster aggregate demand by injecting liquidity into the financial system. This liquidity expansion can lead to increased consumer spending, business investment, and overall economic activity. Conversely, a contractionary monetary policy, such as reducing the pace of money printing, can dampen aggregate demand by limiting liquidity and tightening financial conditions.

Aggregate Demand

Incorporating aggregate demand into the nexus provides a holistic view of monetary policy’s impact on economic outcomes. Changes in money supply and money printing influence aggregate demand, which in turn affects consumption, investment, and overall economic growth. Moreover, fluctuations in aggregate demand can feedback into monetary policy decisions, shaping central banks’ strategies to achieve macroeconomic objectives.

Foreign Reserves and Exchange Rate

Incorporating the value of money against the US dollar into the nexus reveals another dimension. Changes in money supply and money printing can influence the value of the currency against the US dollar, which in turn affects various aspects of the economy such as trade competitiveness and foreign exchange reserves.

Sri Lanka receives foreign exchange from exports, remittances, tourism, investments, loans, and other sources. Commercial banks handle most inflows for their clients, while the Central Bank manages government transactions. When the government needs foreign currency but lacks it, the Central Bank steps in, reducing its foreign assets. To cover this, the government exchanges Sri Lankan rupees with the Central Bank, possibly reducing the money supply unless it borrows more. Once all foreign exchange needs are met, the Central Bank can buy foreign currency from banks, increasing its assets and injecting new money into the economy.

Conclusion

In conclusion, the nexus between money, money printing, aggregate demand, inflation, exchange rate and stock market performance underscores the intricate relationship between monetary policy actions and economic and financial dynamics. While money printing can influence money supply dynamics, its effectiveness and implications depend on various factors such as economic conditions, policy implementation, and market expectations.

Sri Lanka receives foreign exchange from various sources. When the government requires foreign currency, the Central Bank of Sri Lanka (CBSL) uses its foreign assets to exchange Sri Lankan rupees, potentially reducing the money supply unless the government borrows more. After meeting all requirements, the CBSL purchases foreign currency from banks, increasing its assets and injecting new money into the economy.

Hence, it’s crucial to craft policy tools meticulously, navigating these dynamics to meet the country’s goals of stable prices, sustainable economic growth, and financial stability.

(The writer, a senior Chartered Accountant and professional banker, is Professor at SLIIT University, Malabe. He is also the author of the “Doing Social Research and Publishing Results”, a Springer publication (Singapore), and “Samaja Gaveshakaya (in Sinhala). The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of the institution he works for. He can be contacted at saliya.a@slit.lk and www.researcher.com)